Bond ALEMAR – B2C expansion into European markets, coffee oil production with maturity 31. 12. 2027

The information presented here should be seen as a PROMOTIONAL SENTENCE. Approval of the Prospectus should not be construed as an endorsement of the securities being offered or admitted to trading on a regulated market. Prospective investors are advised to read the Prospectus together with its final terms before making an investment decision in order to fully understand the potential risks and rewards associated with a decision to invest in the Securities.

When you buy 3 or more bonds of this issue, an extraordinary discount is now valid, thanks to which the fastest ones will see their savings appreciate by 17% P.A.!

- Who are we?

- What makes our technology unique?

- What is our market position?

- How do we plan to expand production?

- Turnover and profits at each stage of expansion?

- How realistic is it to sell the production in the single expansion phases?

Who are we?

ALEMAR Food Group s.r.o. is a holding company that produces high quality canned meat directly in the Czech Republic, in Žabčice. The company has been producing canned food for dogs and c ats since the end of 2016 (previously under the name Martypet s.r.o., which is now ALEMAR Service s.r.o. and is wholly owned by the Issuer) and we have recently launched a canned food production facility for humans.

These preserves are then marketed by ALEMAR Real and Trading s.r.o., which is the distribution company of the holding and also carries out B2C retail sales of the LOUIE brand.

What makes our technology unique?

Our products have become successful thanks to our unique sterilization method, where we can sterilize even canned food without any preservatives, thickeners and gelatin.

Surely everyone has noticed that no matter how much pate, stew, or any other can of meat they open, they find jelly inside. Meat also tends to be pink instead of the natural colour of roasted or cooked meat.

Of course, there are reasons for this. You can extend the shelf life of meat in several ways:

- Pasteurization: the fermentation of meat is caused by bacteria that break down the proteins in the meat on which they feed and their metabolic processes produce toxins, odorous gases, etc. Pasteurisation is a process in which bacteria are thermally destroyed by heating to at least 70 °C. C, which kills them. However, the problem remains in the so-called. spores, which are basically like bacterial eggs. These are much more durable and will survive this temperature. At temperatures above 5 deg. At temperatures above 5 °C (mostly at around 37 °C), they start to germinate and give rise to new bacteria, which continue to multiply and cause spoilage of the meat. Therefore, among pasteurised foods include e.g. ready meals that need to be stored in the fridge.

- Pasteurisation + chemical preservation: if we want to prevent spores from germinating on bacteria and multiplying further, this process can also be prevented chemically. I.e. by changing the chemical environment in which the bacteria and spores are found. Bacterial proliferation can be prevented, for example, by lowering the pH (i.e. an acidic environment), which can be observed e.g. for pickles in brine, which last (before opening) a very long time outside the fridge. However, it would hardly be appreciated by dog or man if the meat was canned in vinegar brine. So this path is useless for us. Among the chemical preservation methods, E250, or sodium nitrite, is mainly used for meat . This is a toxin that kills both bacteria and spores and thus preserves the meat. It also has the specific property of giving meat preserved with it a typical pink colour. This is why all sausages, hams and other meat products are pink. Thanks to this preservative, a hiker can carry such a highland straw in his backpack for several days without fear of poisoning. However, the problem is that this preservative is toxic and also reacts with HCl in the stomach to form nitrosamines, which are carcinogenic. That is why we do not consider this path to be ideal either.

- Sterilization at 121 degrees. There is another way to solve this problem. And that is to heat it to 121 degrees. C in the core, which reliably destroys both bacteria and spores. However, even this has its pitfalls. At a temperature of 121 deg. C, the juice that the meat releases when heated becomes steam, which pressurizes the can and it explodes. That’s why it’s not actually sterilised at home, it’s just pasteurised and always to the boiling point. In order to reduce the internal pressure in the can, gelatin is commonly added to bind the moisture from the meat and thus prevent overpressure inside the can. Various starches or other vegetable thickeners can fulfil a similar function.

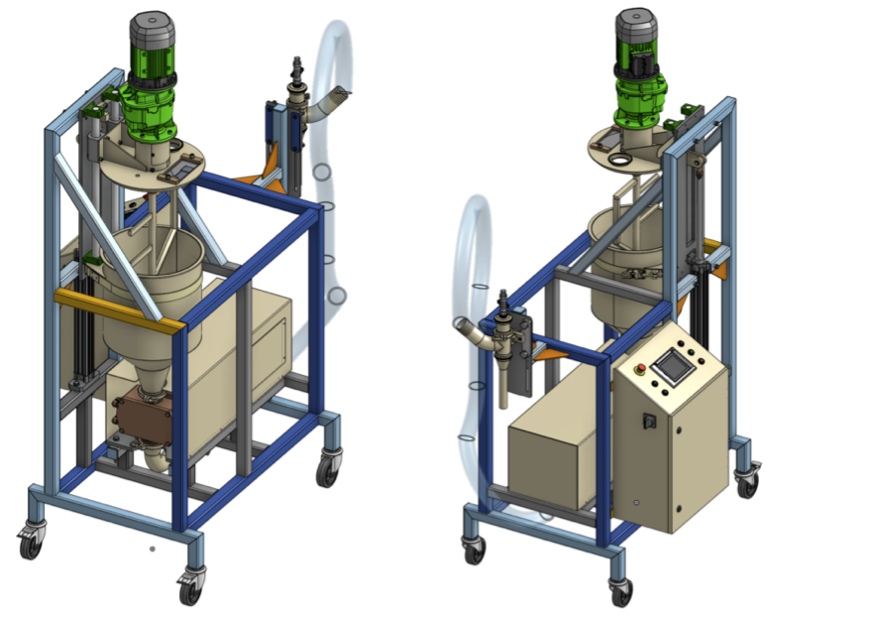

- However, the UNIQUE TECHNOLOGY of ALEMAR FOOD GROUP can sterilize at 121 deg. C in the core without any thickeners, without exploding! This has enabled us to market canned products made from 100% pure meat.

However, with the increase in demand and the associated increase in production capacity, we have also started to offer, especially for private labels, conventional canned formulations, which are in great demand, especially from customers who want to replace their existing private label manufacturer with us.

What is our market position?

Pet Food is still by far the most important sector for us, and after the Covid pandemic we found ourselves in a situation where we are registering requests from dozens of people interested in producing Private Labels that we are unfortunately unable to produce at the moment. However, our company already produces private labels for the strongest dog and cat food brands not only in the Czech Republic but also in other European countries. The strongest customer is Germany.

It is in order to expand its production capacity – and to gain the possibility to implement projects that are already in demand, to strengthen its own brand LOUIE(www.louie.pet) and to synchronize, set up processes and operate the “enlarged” company, the company decided to issue a prospectus for the issue of bonds, which was approved by the Czech National Bank!

How do we plan to expand production?

In total, we are planning 4 phases of production expansion, when at the end of this expansion we should have 4 autoclaves in continuous operation, sterilizing depending on the size of the package from about 50,000 pcs to 150,000 pcs of cans per day.

At the moment we are almost in the second phase of the expansion, which in short means the capacity of two sterilization autoclaves. Although we already have these in our production facility in Žabčice, we lack the machines to fill a sufficient quantity of product. However, these have been ordered and will be delivered by 31. 5. 2023. At this stage, we will also expand with a more powerful pocketing machine and up to 30. 6. 2023 and a labeller with a production volume of up to 6,000 pcs per hour. We already have a subsequent automatic packaging tunnel, which can fold the shape of the package and seal it in the necessary capacity in foil and label it, in our hall.

The third phase of the expansion will correspond to three autoclaves and will have the highest investment burden. In addition to the autoclave, it will be necessary to purchase additional filling equipment with a capacity of up to 6,000 pcs per hour incl. affiliations, such as. pumps for meat mixture and others. This will also create demands on the preparation of the raw material and thus on mixers, mashers, etc. Then, of course, there is the cost of the autoclave. The entire labelling and packaging part will have to be doubled at this stage, but this will be sufficient for the fourth autoclave. It will also be necessary to expand the freezing and thawing capacities.

The fourth phase of the expansion will be less investment-intensive, as most of the technology should be ready for the addition of the fourth autoclave. However, we will also focus more intensively on automation and robotics.

Turnover and profits at each stage of expansion?

Based on current sales prices and material prices, we have made a calculation

capacities according to the individual phases of the extension.

On the basis of current sales prices and material prices, we have made a calculation of capacities according to the individual phases of the expansion.

Present, 2. expansion phase:

- For exclusive B2B sales:

turnover: 168 000 000 CZK per year

Profit: 38 000 000 CZK per year - With 1/3 of B2C sales:

turnover: 236 000 000 CZK per year

profit: 114 000 000 CZK per year

Phase 3 expansion:

- For exclusive B2B sales:

turnover: 345 000 000 CZK per year

profit: 110 000 000 CZK per year - With 1/3 of B2C sales:

turnover: 486 000 000 CZK per year

Profit: 234 000 000 CZK per year

Phase 4 expansion:

- For exclusive B2B sales:

turnover: 485 000 000 CZK per year

Profit: 142 000 000 CZK per year - With 1/3 of B2C sales:

turnover: 683 000 000 CZK per year

Profit: 280 000 000 CZK per year

How realistic is it to sell the production in the single expansion phases?

Selling is not what the main problem would be. If we only talk about the demand for canned food for dogs and cats, the market demand for a good quality product is enormous and given the “back to nature” trends, we expect further growth in the wetfood segment. We are not afraid of a possible decrease in real wages of the population, because we target customers who buy quality and the difference in the financial intensity of canned food compared to high-end granules is not significant.

What we need is sufficient production capacity and automatic machines that guarantee 100% quality and prevent human error.

At the moment, we have about 30 requests for tens to hundreds of thousands of cans, which unfortunately we are unable to produce either for capacity reasons or because we lack the right type of filler. The advantage is that the preparation of private label projects usually takes a very long time (sometimes over a year), as it is necessary to prepare recipes, samples, test variants, prepare packaging designs, make translations, legislative proofreading, produce packaging, etc.

This gives us time to expand capacity. Implementing only the current demands and business negotiations would move us somewhere towards fulfilling Phase 3 of the expansion. However, we do not expect all of them to be realized. At the same time we’re counting on 4. the expansion phase and therefore we are already initiating further commercial negotiations about further private label production, which we plan to launch after the completion of the 4th. expansion phase.

In practice, this means PPC campaigns focused on PL production, participation in trade fairs, etc.

Many enquiries are coming to us from the European market leader in canned dog food, which is extending delivery times and increasing MOQs. For many customers it is no longer interesting and they demand its replacement.

In addition, we have our own brand LOUIE and B2C sales on www.louie.pet plus a whole canned food market that we’ve barely touched yet.

If we recalculate the turnover in each phase to the number of dogs in the country in %, how many dogs would have to consume one pack of cans (8 pcs) per month to meet our targets, we find that the targets are not inflated:

- Phase 2: 3.24%

- Phase 3: 6.67%

- Phase 4: 9.36%

And let’s remember that we are not limiting ourselves to the Czech Republic!

Expressing the same as a % of turnover of the market leader in the canned dog food industry in Europe, we arrive at the following figures:

- Phase 2: 3.39%

- Phase 3: 6.97%

- Phase 4: 9.8%

This means that even in the last of the 4 planned expansion phases we don’t need even 10% of what the market leader in Europe has. And of course it does not hold the entire market share, but about 20%.

In short, we only need a 2% market share, and that’s just from the canned dog market, to meet all our targets and sell all our production after the expansion . Canned food for humans is an added bonus.